When we give a gift, usually that act begins and ends with the gift itself. We usually don’t think about what, if anything, we’ll get out of it. However, charitable gifting allows us to support the causes we hold in high esteem, and in many cases, see a real taxable benefit when all is said and done.

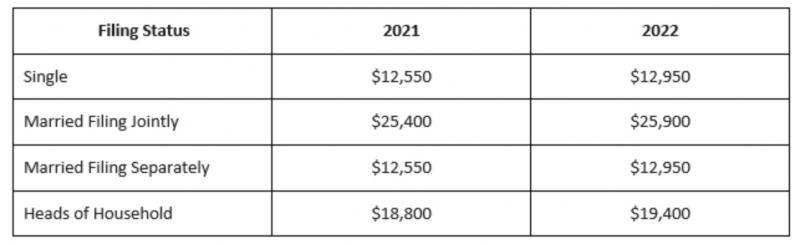

Now, you can always make a gift without claiming it on your tax return. In fact, this ends up being the case for many, particularly those for whom deducting would not be beneficial because charitable deductions need to be itemized. If the value of all your itemized deductions (e.g. your charitable gifts, medical expenses, taxes already paid, etc.) is less than your standard deduction, your gift is still doing all the good for the charity, but you won’t be seeing any real tax benefit from it.

For example, let’s say you’re married filing jointly in 2022 – if the sum total of all your donations, as well as everything else, was under the $25,900 mark, it wouldn’t be worthwhile to itemize. So if you donate with the intent to take deduct the said amount on your taxes, just be wary of whether or not your total itemized deductions exceed that standard deduction. With all that said, let’s take a look at how you can make an eligible charitable gift:

We’ll start by outlining who counts for charitable gifting: For a gift to count, it will need to go to a nonprofit – gifts to individuals, political campaigns, etc. won’t make the cut. So, you can give to a university, but giving your nephew money for his tuition doesn’t qualify. In general, a nonprofit will qualify as a potential charitable organization if they have a religious, educational, literary, charitable, or scientific purpose and 501(c)(3) status from the IRS (think your local church, public school, or library). If you’re unsure, the IRS has a handy tool to look for organizations that quality, which you can use as a resource to vet and research a given charity.

Let’s take a moment to quickly touch on the difference between a charitable gift and something else we’ve talked about before: a Qualified Charitable Distribution. While both of these funding methods go to the same kind of organizations, their tax impact and strategy are different – a QCD is money taken directly from one’s retirement account and given to a charity, which prevents said money from counting as income the way it usually would when you withdraw funds. You do not need to itemize to take advantage of a QCD. It instead nets against your income, which can be a handy way of keeping a Required Minimum Distribution from causing you undue tax grief.

When you’ve confirmed that your org of choice is eligible, the next step is knowing what counts as a contribution. Cash is, all-around, the easiest to give. That’s not to say that you shouldn’t give other items, but determining and filing a non-cash gift can get tricky pretty quickly, depending on the value of the donations (which we’ll dive into below.) So what non-monetary stuff can be donated? Clothes, art, highly appreciated stock, food, raw materials, and much more are all eligible – the tricky bit comes from calculating the value of said donations, and then how you end up claiming them on your taxes –

| Donation: | What You’ll Need: |

| Non-Cash Gift under $250 | A receipt from the charity and to have the receipt on hand to file your taxes. |

| Non-Cash Gift of $250-500 | A written acknowledgment from the charity 1) describing the item 2) denoting whether the charity provided anything in exchange for the item, and a good-faith estimate of the value of the goods/services if rendered. |

| Non-Cash Gift $500-$5,000 | The written acknowledgment above, plus written evidence of its acquisition date, fair market value, cost, etc. You’ll also need to fill out IRS Form 8283. |

| Non-Cash Gift over $5,000 | Fill out IRS Form 8283 and obtain the written acknowledgment. You’ll also need a qualified appraisal, which certifies the value of the said item. |

The above represents a rough summary of what is applicable to the most common types of non-monetary deductions. Because this type of donation is near limitless, this table should be considered a guideline that can help you begin to navigate your situation (or, if the above seems a bit convoluted for your taste, it may be the deciding factor in making a gift of cash.)

We mentioned highly appreciated stock before – not everyone has an original Monet in their living room, but it’s a pretty safe bet that you have some appreciated stock in your portfolio, so let’s explore this in a little more detail. There are a number of reasons this is a great idea: the first is that if you donate the stock directly instead of selling it and donating the proceeds, you’re donating up to 20% more than if you had given away the cash. This is because you’re avoiding the capital gains tax associated with the sale, so you can give the charity the entire value of the stock! Another potential benefit is, that if you’re attached to a given stock and want to hang on to it, you can donate some appreciated shares and buy new shares at the current, higher prices, essentially resetting your basis. This lowers future capital gains taxes if the stock continues to grow into the future.

Regardless of whether you end up being able to deduct a charitable contribution on your taxes, ultimately the gift itself will be doing the same amount of good for whoever you donate it to. So, the next time you support a cause you believe in, feel free to reach out to us to see whether or not it might make sense to factor it into your taxes – but know that either way, it will simply be the cherry on top of an already wonderful deed.

Thanks for your blog, nice to read. Do not stop.