how we work

Starting your plan.

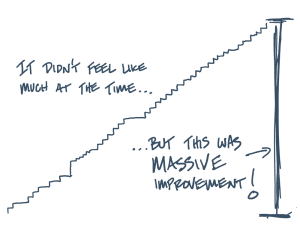

The most essential step to take in building the life you want is to start.

Your

Plan.

Step 1: Let’s Chat

Our sum total life planning process is equal parts personal coach, behavioral science, and financial planning, mixed with all ears. During our 60 minute meeting we will discuss your financial life at length to determine if GDP is right for you.

Step 2: Explore

The first step to making positive change in any area of life is awareness. In the explore stage, we’ll talk about where you are now and what a great life looks like to you (and your partner if you have one). We use a variety of tools and techniques to help you uncover where you are now, what’s important to you, and what changes you’d like to make.

Step 3: Envision

We will spend time putting together specific goals that are connected to the great life you envision for yourself and the opportunities and obstacles you will face on your road toward acheiving them.

- What gets you up, what keeps you up?

- Your Roles, Goals & Dreams

Step 4: Enlighten

At this stage we begin putting all of the pieces together. Your financial life plan is based on your vision of a great life, connected to specific goals based on what’s truly important to you, and fortified by a financial roadmap we’ve created by working together.

Step 5: Empower

Working on your plan is just as important as building a plan, so we’ll continue to work together to review on your progress and renew your plan. Depending on the complexity of our plan we might meet as often as monthly or less frequently, 2-3 times a year.

- Goals tracked

- Opportunities pursued

- New goals defined

Step 2: Explore

The first step to making positive change in any area of life is awareness. In the explore stage, we’ll talk about where you are now and what a great life looks like to you (and your partner if you have one). We use a variety of tools and techniques to help you uncover where you are now, what’s important to you, and what changes you’d like to make.

Step 3: Envision

We will spend time putting together specific goals that are connected to the great life you envision for yourself and the opportunities and obstacles you will face on your road toward acheiving them.

- What gets you up, what keeps you up?

- Your Roles, Goals & Dreams

Step 4: Enlighten

At this stage we begin putting all of the pieces together. Your financial life plan is based on your vision of a great life, connected to specific goals based on what’s truly important to you, and fortified by a financial roadmap we’ve created for you together.

Step 5: Empower

Working on a plan is just as important as building one, so we’ll continue to work together to review on your progress and renew your plan. Depending on the complexity of our plan we might meet as often as monthly or less frequently, 2-3 times a year.

- Goals tracked

- Opportunities pursued

- New goals defined

Are you ready to plan your great life?

Frequently asked questions…

Why should I hire GDP?

Great question. We focus on what you can control. Working with us, you will find and refine your ‘why’. We focus on you. If you’re interested in defining, building, and working on a plan that accounts for the things that truly matter in your life, you’re in the right place. If you want a portfolio that is designed to be tax-efficient, stress-tested, low-cost and connected to your goals, you’re still in the right place.

Who is your typical client?

Inside our family of clients are a number of different stories. Each of them works with us to build a life they want. We don’t really have a typical client.

We serve high-income earners who aren’t rich (yet). Many of our clients are nearing or are in retirement. Some of our clients have inherited their money (and the new responsibility that comes with it). We’ve found we often have a fit with creative people and professionals in the legal, technology, and film industry. We serve a number of small business owners who are looking to maximize their retirement savings. We have experience with RSUs, ISOs, Defined Benefit Plans, and Cash Balance Plans.

With each of our clients, they want to spend their time living the life we’re planning together, and to have a relationship with a trusted advisor to guide and protect them. In short, we have a range.

How often will we meet?

Our answer depends on what’s the right solution for you. It could be as often as once a month or as infrequently as two to four times a year.

If you could use help with building and maintain a budget, it could be monthly for six months, until you get the hang of things. If you’re nearing a significant transition, we might need to talk more often too. We’ll agree on the schedule you’d benefit from before we start working together, and check-in to make sure that’s still feeling right as we go along.

Do you need to manage our money to work with us?

Nope. We’re here to make sure your plan is sound and will give you advice on how to manage your money, but managing your money is not a condition for working with us together as a planning client. To be clear, though, we don’t just build plans for you to take home and put in a drawer. Each planning quote we provide also includes us working with you to execute on that plan as well.

Many of our clients do have us manage their money to ensure it is working according to their plans. Aside from making their life more comfortable, we offer savings when we do.

What are your average returns for clients?

Life isn’t one-size-fits-all and neither is our approach to managing your portfolio. We don’t really have an average return to share because each of our clients’ goals and situations is different. As a result, their returns are different.

That being said, if you’re here for market-beating returns, we’re not the firm for you. Our goal to make sure you are educated about your portfolio risk, smart about taxes, cost-conscious about fees, and have a portfolio (and plan) that are based on what’s reasonable to expect using historical data, including the what-ifs.

How much do you charge?

Before we begin our work together, we’ll spend time learning more about the complexity and on-going work that will be needed to get you on your path. We’ll provide you with a quote to consider. Our financial planning process starts at $3000.

If you elect to work with us to manage your assets as well, our flat fee includes planning and asset management. We typically start at 1% for our combined work. Occasionally, this formula results in too high or too low a fee for the amount of work needed, and we’ll mutually agree to adjust your quote.

Gross Domestic Product, Inc. is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where GDP, Inc. and its representatives are properly licensed or exempt from licensure. This website is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by GDP, Inc. unless a client service agreement is in place. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise states, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein.