While we can’t know the outcome in Ukraine or what comes next, what is clear is that the road ahead is likely to be bumpy, and almost everything is about to get even more expensive.

While the human cost and suffering are front and center, it’s the inflationary effects that are almost inevitable at this point, but crazily enough, still not fully realized by the market, in our opinion.

The crop planting season in Ukraine was supposed to start in March, and most definitely did not. Ukraine and Russia provide roughly 20% of Europe’s wheat. Ukraine also produces 13% of the world’s maize and 12% of its barley. Meanwhile, Russia controls approximately 20% of the world’s potash supply, one of the main ingredients for fertilizer, which has farmers scrambling for supply, or using less, which then creates a negative feedback loop with lower yields. A global food crisis seems unavoidable at this point.

Meanwhile, over 90% of US semiconductor-grade neon comes from Ukraine, which also supplies 70% of the world’s supply. 35% of palladium imported to the US (used in catalytic converters) normally comes from Russia. The spot price for nickel surged so high at one point last month that they needed to close the market. Russia accounts for 7% of its world production, a key ingredient in steel manufacturing and batteries.

Elsewhere, one of Ukraine’s largest exports is a vehicle’s wiring harness, the entire nervous system of an automobile. They supply 7% of the total market in Europe, a development that is already hitting VW, Porsche, Audi, BMW, and Mercedes production as critical components run short. And, that’s on top of the chip supply issues we already have.

Adding further pressure to the already dysfunctional supply chain, China is shutting down again, as they have a new Zero-COVID policy. It’s been enacted in two of its largest manufacturing districts. Already companies are warning customers again, creating more supply issues still.

As a result of these supply constraints, and yet somehow combined with a healthy job market, and momentum maintained in consumer demand, US inflation is tracking at roughly 8% currently.

That said if you weren’t feeling inflation’s sting a month ago, it’s impossible to not notice now. I tried to fill up our Toyota Highlander for a road trip recently. The pump stopped at $100 because it’s not programmed to pre-approve more. Our tank still wasn’t full.

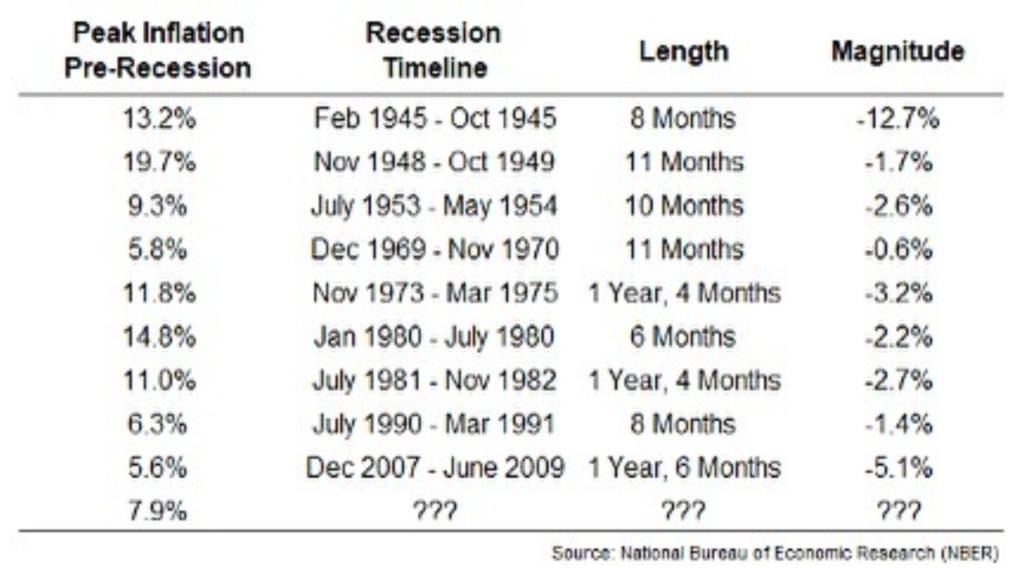

Now, history shows us is that 9 out of the last 9 times when there’s been a spike of 5% or more in inflation, a recession has followed. This chart also shows the market’s reaction.

Of course, this time might be different, and there is no crystal ball regarding how long or how deep the next recession will be. In case you’re wondering, this is not a timing indicator. Nor is the flat yield curve you are probably hearing about in the news, which is also signaling a warning about a coming recession as well.

They’re never fun, but it’s also important to remember that recessions are a necessary, healthy part of the economic cycle. Trimming the inherent excesses of the systems is also necessary for future growth, much like pruning a tree.

While almost every company and investor will feel the effects of a recession and those who don’t invest wisely might not survive, a recession is a reminder for people and companies alike to stay on top of their finances. It is also a reminder that speculation can actually lead to losses. And, with “meme-stock” becoming part of the vernacular over the last two years, it’s safe to say there’s been just a wee bit of speculation driving this market.

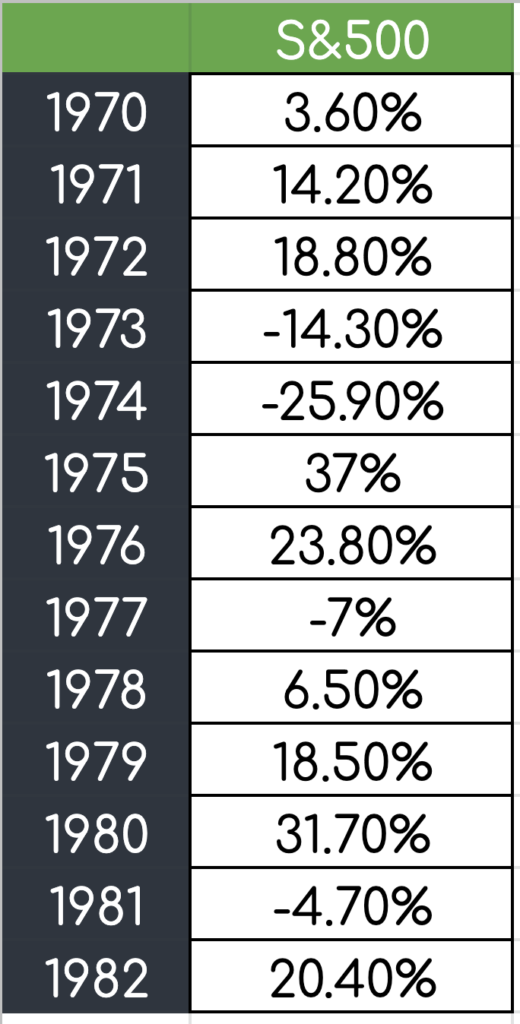

With inflation like we are seeing right now, there have already been comparisons to the 1970s, especially since there’s the energy component – which is apt. To give you some perspective, below are S&P 500 total returns during this period. They were volatile, and not just because of stagflation, which is something we could also experience for the first time in the 21st century.

Note 1973 – 1974. This is when the oil shock happened. And during this same period, the 2-year drawdown was 37%, as bad as 2008. Is that what we are going to see this time? Not inevitably, but we also don’t think anyone should be surprised either.

It doesn’t take much imagination to realize that market is going to be a little manic about whether the Federal Reserve is navigating us toward a soft landing or the road to ruin, while still driving the car, especially while the planet burns and “nuclear” is in the news.

Raising rates is usually the tool used to squash inflation by killing demand, but that’s also a bit like using a shotgun to scratch a mosquito bite this time around. While the market will need to digest “how much” or “when”, raising rates still doesn’t do anything to address the supply chain issues presently, or coming soon. So, results may vary.

No pressure, right? But, of course, the game of life is always high stakes. And, with any portfolio, the calculus is timeless and simple. In order to earn higher returns, a bigger percentage must be invested in equities. And, as a result, the bigger the mood swings, which you’ll also need to endure. Still, in the end, equities were one of the few assets classes that actually kept up with inflation during this period.

With all that said, we believe it’s important to temper your expectations that we’re back to the races even though we might string together a positive week or two in the market anytime soon. This latest quarter marks the first quarterly loss in two years, with the S&P 500 finishing down 5.16% and the Nasdaq down 9.63%. The S&P 500 had its fifth-worst January – February in history and bonds wrapped the second-worst ever start to a year, according to Blackrock. These indexes also finished under their 200-day moving average, which, to us, signals noteworthy structural issues.

We think it’s important to remember that rallies in this type of environment can be (extremely) powerful, but still not lead to higher highs. With most major equity asset classes across the globe still being in a major downtrend, the longer it remains there, the more negative feedback loops affect equity prices.

Two important things to remember during moments like this are practicing patience and using this recent market correction to make sure you feel comfortable with your asset allocation. If your portfolio is down more than you’d like right now, you should think about adjusting your risk because it could get much worse from here.

Until we see more strength from the market, we believe it’s very likely we are in the midst of a cyclical bear market within a secular bull market. That said, this market has been surprisingly resilient given the torrent of bad news.

If a spike in interest rates is indeed an indicator of what’s to come, a recession may be looming, but household and corporate balance sheets are in pretty good shape to weather what might be coming our way.

That said, while demand has been resilient, the American checkbook isn’t immune and demand is starting to soften, and more quickly than we think most are accounting for. If even Apple, which normally has its finger on the pulse of consumer demand, this week reported a 20% cut in production on its newest low-cost iPhone, we are not uncertain that others will be doing the same soon.

The good news is that the amount of investment in US factories and manufacturing around the world to remove our reliance on China and diversify our supply chain is staggering. In just the last year, companies have announced nearly $200 billion in investments allocated to semiconductor, electric vehicle, and battery manufacturing in the United States. None of it will come online overnight, but it is coming. There is a light at the end of this tunnel, but don’t be surprised if it’s a slog from here, for a while.

For some investors, presently, we are recommending reducing risk a bit but, in general, we believe that staying the course is the best action to take at this time. At GDP, we do not see a reason to make any big changes to our portfolios because we’ve already been positioned for inflation for quite some time. That said, while it is not our base case, we would not be surprised if we experience a bear market in the broad market sometime later this year, with the potential for another crisis to contend with.

We continue to monitor all of these situations and we are prepared to take further action if necessary.