When the US market closed for trading on September 30, 2022, the S&P 500 finished -8.63% for the month and -24.77% year-to-date.

This last month was the worst since the panicked pandemic sell-off in March 2020. It was the worst September since 2002, which was part of the aftermath of the dot-com bust. Meanwhile, the S&P 500 has fallen for three consecutive quarters, with losses investors have not faced since 2009. Tallying up yet another historical record, this is the third worst start to the market since 1931.

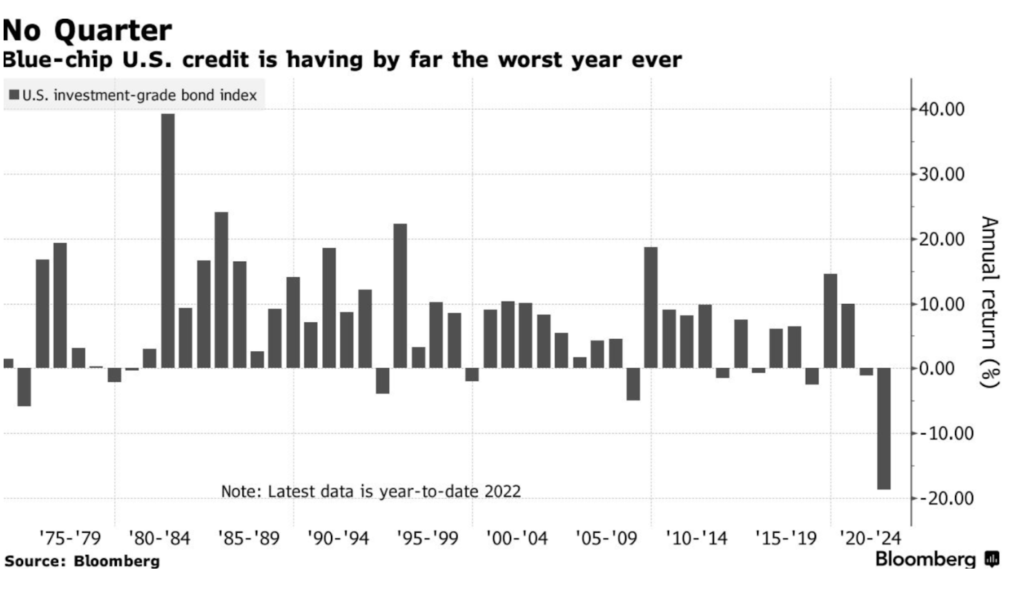

While fixed income has historically been a safe haven, even US investment grade bonds have been crushed, posting the worst year ever due to rising US treasury interest rates. The credit risk component of the bonds (the extra yield they offer above treasuries) is still at an average level and not yet cheap.

While these last two days of rallying in the equity markets have probably provided some psychic relief, these are trying times.

Inflation Update

The August CPI and PCE inflation numbers released last month, which the Federal Reserve weighs quite heavily in its calculus regarding interest rates, showed inflation remaining stubbornly (and surprisingly) high. There are some nuances, and one could point to specific areas as showing improvements, but at the end of the day, the headline numbers were far too high for the Fed’s comfort, and optically they are locked into having to continue to increase rates. As a result, the Federal Reserve raised rates 75 bps last month and telegraphed another 75 bps hike in November. The market’s reaction was decidedly adverse.

While oil and natural gas prices continued to soften in September, wheat prices resumed their upward trend, and the most recent employment numbers were still quite strong. Farmers globally skimped on fertilizer applications this year due to higher prices stemming from higher natural gas costs, it is likely that crop yields will decline and put a floor under agriculture prices.

We won’t hear from the Federal Reserve again until November regarding any further increases in interest rates. Still, all eyes will remain on the inflation, employment, manufacturing, and real estate data until such time, and the market will likely move accordingly.

Elsewhere, the average 30-year mortgage rate is now 6.85% and is most certainly cooling the demand for real estate. While US real estate has begun to soften, it is still the most unaffordable it’s ever been, growing roughly 40% over the last two years alone. With 85% of mortgages at 5% or lower, we are not anticipating a 2008-2009 crash in the real estate market. Still, we expect a meaningful correction to come sooner than later simply to account for the massive increase in borrowing costs these last ten months. We believe investors would be wise to remember that the housing sector is one of the most far-reaching in the economy, affecting 15-18% of the US GDP.

With all the unknowns at the moment, what we know at the press conference following the latest rate hike, Federal Reserve Chairman Powell was very direct in saying that they do not anticipate backing off their campaign to crush inflation.

From Bloomberg:

The key point that Powell wants us to get, possibly both consciously and subconsciously, is that we should all regard him as the second coming of Paul Volcker, the great Fed chairman whose repeated rate hikes at the beginning of the 1980s are held to have slain inflation. It might almost be subliminal. Edin Mujagic, the Dutch economist, wrote to me to point out how closely Powell is aligning himself with his predecessor:

At the press conference, Powell said the Fed will continue with interest rates or, in his words: “We will keep at it.” I don’t think it’s a coincidence that he used the exact same phrase in his Jackson Hole address in late August. How can that be seen as a hint? Paul Volcker’s memoirs are entitled ‘Keeping at It,’ with the subtitle, ‘The Quest for Sound Money and Good Government.’ Obviously, the first part of the subtitle is related to Fed policy. Powell has been citing Volcker regularly lately, as an example of what the Fed should do in 2022 and 2023.

Powell said they are also willing to accept a recession as part of the “pain” required “until the job is done.” While there is now some dissent within the Fed Committee about how much further they need to raise rates, there’s still near unanimous agreement that once they stop, they plan on leaving this new equilibrium level in place through the end of 2023; “higher, longer.” Today, even after the UN released a public plea to stop raising rates, the New York Fed President, John Williams said, “Tighter monetary policy has begun to cool demand and reduce inflationary pressure, but our job is not yet done.”

Across the globe, central banks are raising rates, creating significant stress within the Foreign Exchange and Bond markets. The UK announced that while raising rates, they also planned on cutting taxes, which is not the prescription for containing inflation. Cutting taxes and funding it with deficit spending for non-dollar countries usually results in a weaker currency and higher import prices into the economy, creating inflationary pressure.

As a result, the UK pound dropped to its lowest level in decades against the dollar, and the yields on long-dated UK government bonds rocketed, causing significant price declines. This forced the Bank of England to intervene in the marketplace by buying government bonds to help protect pension plans that had substantial exposure to long-dated UK bonds. Since that intervention, the UK has reduced its tax-cutting plans based on its incredibly adverse market reaction, which further soothed the pound but did little for the incoming Prime Minister’s administration’s credibility.

Last month, in our letter, we said, “We think that with this much pessimism in the market, the table is set for solid market rallies from here on ANY good news, or less bad news, that is not currently priced into the market. But, it cannot be understated how important it is that the Federal Reserve wring inflation out of the economy, which could cause a more meaningful recession further down the road.”

Indeed, we find it noteworthy that both recent market rallies (last week and these last two days) began with overnight efforts by central banks intervening in their markets to stave off a potential catastrophe within the currency markets; the Bank of England last week, and the Bank of Japan affecting this most recent two-day rally.

Unfortunately, we view these as band-aids sitting on top of traumatic wounds inflicted on the financial system’s plumbing due to the pressure created by central banks raising rates and removing liquidity from the fixed income markets. To be clear, we’ve not seen this stress level within the financial system’s plumbing since the pandemic of 2020.

Unfortunately, at this time, we are not confident these most recent rallies mark the beginning of a new bull market, nor will they be enough to change the overall trajectory of this market based on the information we have at this time.

For the broad US market to reestablish its long-term trend after September’s losses, it would need to rally roughly 10% from its most recent close to break above its 200-day moving average. This widely followed trend indicator is often used to gauge the overall market’s health, albeit not perfectly.

Furthermore, on a technical level, if we zoom out a bit further still, the S&P 500 Index is close to testing its 200-week moving average (3595). This long-term technical support level has triggered a bounce during multiple selloffs in the past. And, to be clear, it did so again last Friday. The general wisdom is a meaningful move below the 200-week moving average would signal the end of the secular bull market, which many argue began in 2011 following the recovery from the Great Financial Crisis/Recession.

That said, the historic bedfellows surrounding when the level was breached are ominous, to be sure. Most recently, they were after the dot-com bubble’s collapse in 2000-2002 and the global financial crisis in 2008-2009. The benchmark fell between 35% and 60% during those periods. After these last two days of a market rally, we are roughly 5% above this crucial level.

While the market’s technicals are weak and arguably fragile, we believe the fundamentals also seem likely to create headwinds.

When we look at many of the biggest names in the S&P 500 and the Nasdaq right now (Apple, Microsoft, Amazon, Meta (Facebook), Alphabet (Google), Tesla, and Nvidia), we believe that what investors must understand is that while these companies have been the foundation for incredible growth and portfolio gains over these last number of years, most of them are also trading at multiples that are still not pricing in any sort of recession that seems increasingly likely to be coming our way.

Historically, coming out of recessions, the 100 largest companies in the Nasdaq have traded at roughly 13 times earnings. Right now, they are trading at roughly 17 times earnings. This current valuation is also before any earnings are revised lower, which seems likely since the Federal Reserve’s stated goal is to slow down the economy. As such, we believe that valuations in the NASDAQ (and S&P 500 to a lesser degree) still seem too rich through this historical lens.

On the news front, next week’s earnings season kicks off in earnest with a look at how the US banks have done this last quarter. This latest quarter was arguably when things became more challenging for companies and consumers. With the US dollar trading at its highest level in 20 years, it will not be surprising to see disappointing reports, but we shall see, and if not, this could pull the markets higher in the near term. That said, while it’s possible this market might whistle past the graveyard, we have serious concerns at this time.

It’s safe to assume this week, on Wednesday, October 5, everyone will be waiting to see how much OPEC cuts its oil production to juice prices higher as prices have remained below their $100 price target (currently 83.33 a barrel).

Also, this Friday, October 7, US Non-farm payroll will be the other indicator everyone will be staring at to see if there’s weakness in the numbers that will allow the Federal Reserve to raise rates more measuredly.

While the clear and present dangers are front and center, it is also important to note that, historically speaking, from a seasonal standpoint, this is the strongest part of the calendar year for the equity markets, especially in mid-term election years. Of course, we can’t know if this historic year we’ve been suffering through will continue to be the outlier, with more suffering still on the horizon.

Given the current state of the market, we continue to believe remaining defensive and conservative is the most prudent course of action. As always, we are monitoring the markets and portfolios, and we continue to be ready to make changes as necessary. If you have any questions about your portfolio, contact us anytime. We’re here for you.