When the US market closed for trading on October 31, 2022, the S&P 500 finished up 7.99% for the month and -18.76% year-to-date.

If 2022 has been anything, it’s been historic. While September’s market performance was the worst since 2002, October was for best for the Dow best since 1976. That said, we’d be remiss not to mention that after that rally in 1976, the market declined by another 17%. So, as we begin to close out 2022, as much as we may wish for it, the volatility has not diminished, and nor do we anticipate it will sooner than later.

Inflation Update

Unfortunately, all we need to do is copy and paste what we said last month concerning the monthly inflation numbers. The September CPI and PCE inflation numbers released last month, which the Federal Reserve weighs quite heavily in its calculus regarding interest rates, showed inflation remaining stubbornly (and surprisingly) high. As a result, the Federal Reserve raised rates by another 75 bps.

One thing that was different about this meeting is that the Federal Reserve acknowledged that they’d done a lot in a short amount of time for the first time since they began increasing interest rates. They also acknowledged that we’ve likely not seen much of the effects take hold within the economy (believe it or not). They suggested that this means future rate hikes from here might be smaller. The market rallied after hearing this. But, and it’s a big but, they also said, at this time, they may need to raise the overall interest rates higher than they initially anticipated and is being forecast, which promptly sent the market decidedly lower. While the market has rallied off the recent bottom of the Fed decision, the S&P 500 is still 1.3% below when the announcement was made.

How much did markets dislike the Federal Reserve Chair’s answers? It was the worst last 90 minutes of a Fed Day for the S&P (-3.2%) since 1994 (when the Fed began announcing policy decisions on the day of the meeting).

Since the Fed Meeting, we’ve also received an update on the job market, which remains strong, with postings outnumbering workers by almost 2:1. Strangely, this good news is bad news for the market. However, the unemployment report released showed 3.7%, higher than the 3.5% expected – which does at least provide some hope that, as painful as it is for people to lose their jobs, the economy is starting to soften, which alleviates some of the inflationary pressures the Fed is trying to tamp down.

Later this week, we will get an update on the CPI inflation index, which the Fed will weigh heavily for their last meeting of the year, announcing their decision on rates on December 14.

Elsewhere, the average 30-year mortgage rate is now 7.32%, up from 6.85% last month. As it stands, rates are now higher than they’ve been for the last 20 years. Not surprisingly, US home sales (new and existing) are posting record declines, on track for their worst performance since 2008.

State Of The Markets

Last month, we discussed the market’s fragility within the financial system’s “plumbing” and the concerns we felt were warranted.

While there has been some repair to the significant devaluation of the UK’s Pound and the Japanese Yen, which was happening at an alarming rate, these two areas still require central bank intervention to soothe, but it does seem to be working. Additionally, we are still seeing liquidity problems within the US Treasury market. Japan has started to pull back on purchasing US Treasuries as it focuses on supporting its currency and as bonds have experienced historic losses this year. As one of the largest buyers of our debt, Japan pulling back may put more upward pressure on yields here, which would not be a positive development. All of this has the US Treasury Department’s attention, as this market is supposed to be the most liquid in the world. Secretary Yellen has suggested they are working on solutions to intervene should a crisis develop, but they do not have a formal plan yet.

Elsewhere, on a technical level, the broad market’s downtrend, using the 200-day moving average, is still in place, needing to rally another 5.11% to reverse this trend. However, we are encouraged (and surprised) to see that the tech-heavy index (the S&P 500) has not declined more as these stocks, on the whole, have lost considerable value since their latest quarterly earnings updates.

Seasonally, we are still in the most substantial part of the year. The midterm elections today might show a changing of the guard with gridlock coming from the Senate and the House with Republican leadership. Historically, this is a bullish development, but this year we will also need to get through raising the debt ceiling, and it is not a stretch to think there will be some brinkmanship at play, also using history as our guide. This will not be a welcomed development if that scenario plays out.

On a valuation basis, broadly speaking, the market’s valuation is still historically expensive, considering we are anticipating a recession. The market’s rally since the last CPI reading has been quite strong despite showing worse inflation than expected. While some of this was due to terrible investor sentiment, the environment has not improved. So, we will be closely watching this next CPI on Thursday to see if this rally can continue on news that may support declining inflation.

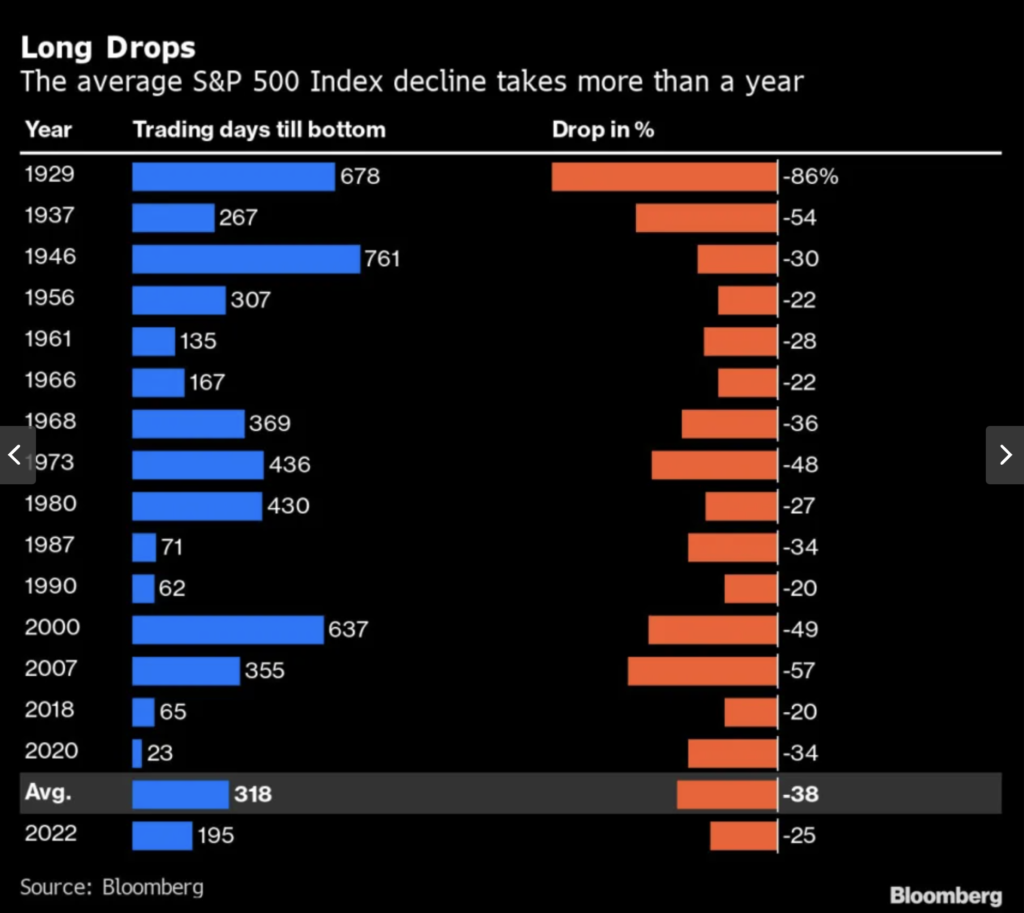

As much as the recent market rally may have buoyed investor spirits, we believe keeping a historical perspective is essential. This bear market, while historic on many levels, is still relatively young in its duration. At its lowest point, the S&P 500 Index fell 25% in a little more than nine months since its January peak, a shallower and shorter drop than is typical of similar instances over the last century. On average, in that time, the benchmark has slid about 38% for 15 to 16 months before reaching a bottom, according to data compiled by Bloomberg. While it might feel like an eternity, we’re still below the average length of a bear market. The chart below might prove helpful in seeing where we are.

That said, we continue to believe positioning portfolios defensively is still warranted and that the risk of recession is still squarely ahead of us, especially as we are just beginning to see layoff announcements begin.

As always, we’re here for you, and if you have any questions about your portfolio or financial plan, please reach out anytime.