April 30, 2022

Russia invaded Ukraine just 65 days ago, and the world feels very different already.

As we mentioned last month, we are beginning to see the supply chain issues hit the automotive and tech sectors quite noticeably. China’s shutdown is also affecting the supply chain, as inflation in energy and food prices does not look likely to decrease anytime soon either.

The Federal Reserve is starting to telegraph that a 50bps rate hike is likely at their next meeting. Already there’s talk that to put the inflation genie back in the bottle, the Federal Reserve is willing to be VERY aggressive in its stance to raise rates further and faster if necessary, which would likely further cool the upside potential to the US economy.

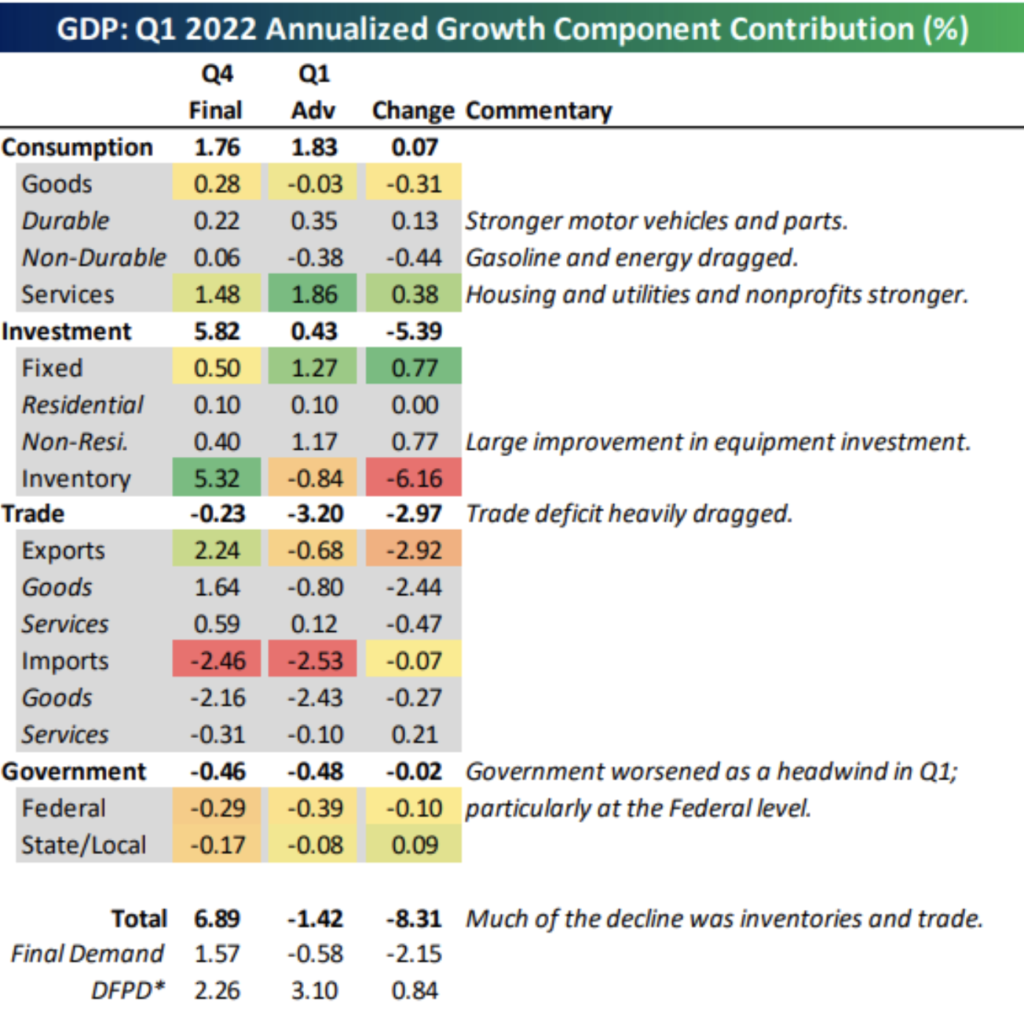

Meanwhile, GDP in the US came in at -1.4%, the first decline since 2020. As ominous as that sounds, it’s important to note that GDP was negative because of increased imports (strong consumer demand). Additionally, a large amount of inventory was built up in the 4th quarter; hence in the 1st quarter, inventory contribution to GDP was very low and a negative contributor overall.

The working definition of a recession is two consecutive quarters of negative economic growth. As we mentioned in our last update, while we cannot know when a recession will occur, given the recent spike in interest rates and the precedent of recessions following, we believe a recession is likely to occur.

Currently, manufacturing in the US remains more robust than expected, and the job market remains strong. Housing starts and new home purchases and permits also reported better than expected numbers. Housing remains strong despite mortgage rates continuing to move higher, with the average 30-year fixed mortgage now pricing at 5.2%.

We attribute much of the continued stability in the housing sector to the secular trend that is in place. There is not enough inventory to soak up demand at current levels. But, every market has its limit, and we would not be surprised to see more sellers entering the market to cash in on what may be the tail end of a historic rise in real estate prices.

Elsewhere gasoline and diesel prices have not stabilized since the US strategic reserve was released. This month diesel was priced at an all-time high. This month, natural gas is also wildly higher, to the highest level since 2008. Elevated natural gas prices in Europe are close to posing an existential threat to many economic sectors across the continent.

These supply chain issues and the persistently high commodity prices will continue to pressure margins and the market’s valuation. We believe that until we have year-over-year comparisons that have accounted for this new higher-priced reality, which would be closer to the end of this year, the environment will remain challenging, all things being equal.

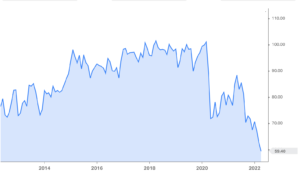

Additionally, the final numbers for April’s University of Michigan Consumer Confidence Index came in slightly below estimates, 65.2 versus the 65.7 expected. The overall downward trend is still in place, which is concerning (note: chart on the right).

70% of the US economy is based on consumer spending. So, a weakening sentiment can become a self-fulfilling prophecy for further weakness due to the negative feedback loop creating subsequently less confidence, which can depress the economy’s collective animal spirits. Franklin D. Roosevelt said it best, “the only thing we have to fear is fear itself.”

State of the Market

The market remains fragile, and if the warning from Treasury Secretary Janet Yellen this week indicates what’s to come, we continue to suggest tempering your expectations and being mentally prepared for further downside. This week Ms. Yellen, during her address at the Brookings Institution, looked at lessons learned from economic downturns of the past and said countries need to build “recession remedies” to protect people in the United States and globally in the future.

With “large negative shocks” inevitable, she said, policymakers have learned from the Great Recession that it’s imperative to exit economic downturns “as quickly as possible.”

“Countries will fare better if their economies are more resilient and less fragile,” she said. “Improved understanding of breaks in supply chains, increases in commodity prices, bursting of asset bubbles, and labor and productivity shocks can help policymakers implement reforms that bolster our economic resilience.”

She spoke at length about addressing issues around the unhoused and the country’s transition to electrified cars and domestic and clean energy. She also spoke about the risks associated with the war in Ukraine, which are mounting as Putin continues to ratchet up his threats against the US and its NATO allies.

Presently, the market is also still expensive, and with the inflationary pressures that we are seeing, we expect valuations to continue to be challenged. The CAPE ratio, a valuation measure designed by Dr. Robert Schiller to smooth out the effect of economic cycles, is presently at 32.58, while the median is 16.94.

Put another way – this market currently is almost twice as expensive as its historical average. On a valuation basis, we are below the Dot-com crash of the 2000s, but above valuations in 1929, before the market’s crash.

This presently high valuation does not mean the market will drop by 50% from here or crash, nor does this metric serve as a timing indicator. Still, as a point of context, this fact is not lost on us, nor is the fact that the market’s valuation has defied gravity for quite some time, as inflation was a non-issue. However, inflation is front and center now, which historically does put pressure on valuations. Also, when economic growth slows, and household net worth and liquidity falls, equity valuations tend to be more scrutinized than during good times when projections are rosy.

One prominent example of the market repricing risk is Amazon. While its revenue numbers came in stronger than expected almost entirely across the board, the inflationary pressures they’ve needed to digest concerning fuel and labor have hit its bottom line harder than expected, reporting its first loss since 2014. In reaction to their latest earnings call, the stock slumped roughly 15%, which is on track for the worst one-day drop since 2008, under heavy volume.

Given the market’s reaction to this particular stock, we believe that we could see it trade lower, with $2000 a share (current price: $2465) being the first significant area of potential support, absent any positive news flow for the company or overall market.

As it is, Apple and Amazon are two of the most widely held stocks in the US market. Despite Apple beating expectations handily, it too traded lower, down 3.5%. These two companies have long been considered the haven from overall market turmoil. Over the last few years, their substantial contribution to the broad market has buoyed the market through difficult times. For the last number of years, Apple and Amazon have often been counted on as the most robust legs of the proverbial stool. The market’s reaction has shown that neither Apple nor Amazon are impervious to what is happening now.

Our opinion is that Apple and Amazon were the two last legs of the stool to support the overall market. Given the market’s reaction to the pressures they face, we feel an important technical part of the foundation of the market has now been shaken. Bear markets have vicious rallies, so this near-term concern does NOT preclude powerful and quick snapback rallies at certain points, but it bears repeating; we still do not see a trend in place for higher highs at this time.

The overall market is on pace for its worst single-month performance since March 2020, the beginning of the pandemic, and the worst start to the year since WWII. Meanwhile, 10-year treasury rates have spiked the most since 2009, yielding 2.937%, as bond prices continue to fall. Year-to-date, The S&P 500 is down -13.86%. The Nasdaq 100 is down -22.10%. And the MSCI All-World Index is down -13.62%.

As a result of the market’s continued weakness combined with the new facts we have in place, we see an increased likelihood of further downside in the broad equity markets. We are currently re-examining our portfolios with this scenario front and center in our minds. If you have any questions or concerns, please don’t hesitate to reach out to us to talk more about your situation.